With the endless regulatory changes in GST filing and requirements, there’s always a need to update one’s knowledge. If you are filing your GST yourself instead of using a professional, it is important to watch out for these common mistakes made while you are filing GST.

Here, in this article, you are going to know about the most common mistakes when filing GST. Also, you are going to learn what is the right way by which you should treat various transactions. It will ensure that you do not face any problem.

What Are The Common Mistakes that GST registered Companies make?

Invalid Tax Invoices

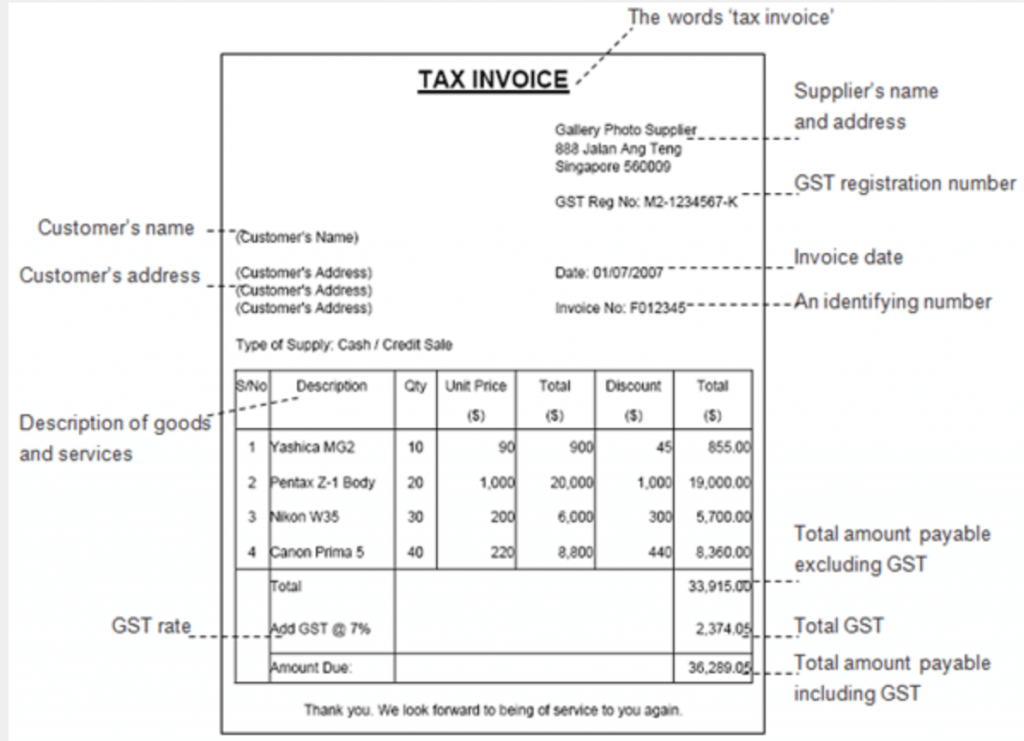

Many people take tax invoices for granted. Once a Company becomes GST registered, they have to issue tax invoices with the appropriate information to their customers if their customer is GST registered. Many times, the Company might not know or be certain if their customers is GST registered, hence, you should always issue tax invoices when you are GST registered.

The invoice must always have the above pieces of information such as the words “TAX INVOICE”, the total amount excluding GST, the total amount payable including GST and the total GST collected. Also, if the Company is invoicing in a foreign currency, the Company have reflect the 3 amounts converted into Singapore dollars, total amount payable excluding GST, total amount payable including GST and total GST payable. Its also allowed to issue a simplified tax invoice for amounts below $1,000.

You may be wondering what if you are operating a B2C business for individuals like an F&B outlet. In that case, you may issue a receipt instead of a tax invoice. A receipt must have a sequential number and have the following information:

- Date of issue of the receipt

- Business Name and GST number

- Total Amount charged

- The words “Price payable includes GST”

It is common to miss out some of the details for changes in the invoices required when your company becomes GST registered.

Zero-Rated GST Charging

International services and exporting of goods are allowed to be zero rated. But what is considered international services? Is it services that is provided to an overseas customers or services that are performed overseas for a local customer? Exporting of goods may appear straightforward but what if you do not know if the goods will be exported? let’s look at what to take note for exporting of goods first.

Exporting of goods

If a Singapore Company sells to an overseas customer and the overseas customer requests for the goods to be delivered to their locally appointed freight forwarder. The Singapore Company is not allowed to charge zero rated GST on the supply. The reason is that the Singapore Company cannot be sure that the goods will be exported out of Singapore. It could be the case that the overseas customer re-sells to a local party and the goods is never exported. In order to zero rate this sale, the Singapore Company have to maintain the following export evidence:

A delivery note/ packing list endorsed by the local freight forwarder with the following details:

- Statement stating “Goods delivered are for export”;

- Name, address and GST registration number (if applicable) of overseas customer; and

- Date of collection of goods.

The Company must also maintain the following transport evidence:

- (a) For exports via sea/ air: – Bill of lading/air waybill

- (b) For exports via land: – Export permit and the vehicle number.

International Services

It is important to know that not all services provided to overseas customers can be zero-rated. There’s an extensive list of services that can be zero-rated at the tax authority website but we want to highlight the most common mistake. Most services provided to overseas customers can be zero-rated when its performed totally overseas, so if the employee fly overseas to perform a equipment maintenance overseas, the sale can be zero rated.

However, there may be many services that are performed locally for overseas persons. For such services, it is important that they fulfill the two main criteria:

- The services must be supplied under a contract with an overseas person; and

- Which directly benefit an overseas person

So, if an overseas company contract you to provide equipment maintenance for its local subsidiary. The service cannot be zero rated as they will not fit the criteria of directly benefiting the overseas person. To qualify, it is also important that the overseas person must not be in Singapore at the time the services are performed. So, if an overseas customer decides to drop by your office and engages you for market research services, you are not allowed to zero rate the sales.

GST Treatment for Gifts and Sale of Business Assets

It is vital to ensure that you are following proper GST treatment for gifts and the sale of business assets while filing GST.

There are times when you give away some gifts to your customers or to your employees. You will need to account for the GST based on the usual sales price of the gifts if

- The cost of the gift is more than $200 (exclusive of the GST amount); and

- You had claimed input tax on the purchase or import of the gifts.

This means that you have to pay the GST which would have been collected on the free gifts to the tax authorities. A common practice is for business to send hampers for their customers during festive days. If the hampers costs more than $200, you will need to account for the output tax on the $200, unless you did not claim input GST on the hampers.

It is important to note that samples are not considered as gifts as long as the samples are given to an actual or potential customer and they come in a form not for public sale (for example, marked with words such as “Not for sale” or “Samples”).

The Disposal and Sale of Business Assets

There are scenarios at times where you dispose of or sell away the furniture, old equipment or computers that you do not want in your business anymore. It can be any business assets or even the office that your Company owns.

When a GST registered Company sells its assets, it is required to charge GST on the amount it receives on it. Even when the Company gives it away for free or donate it, the Company is required to account for the GST on the assets based on the market price of it.

Unless it’s a low value item that cost you less than $200 and you did not claim input tax on the asset before.

Summary

Filing GST properly may seem straightforward, just add up the GST on your purchases and net off against those on your sales, but as we can see, there are many situations when the Company is not allowed to charge GST and there are times when you have to account for GST even when the Company did not make any sales or receive any payment. Therefore, many companies still choose to entrust the filing to professionals like us.

Do talk to us if you have any questions about GST in Singapore. You can drop us a note at the Contact us form or if you want to leave the hassle of filing your GST to us by engaging us, do let us know.