Are you establishing a new business in Singapore? Well, good luck! But, first things first, have you registered for GST? Yes, if the expected turnover of your company is more than S$1 million, you need GST registration. As long as the Company is reasonably certain that its revenue is going to exceed $1 million, it’s compulsory for the Company to do GST registration.

If the Company’s revenue exceeds $1 million and the Company did not do GST registration, you can get into some real trouble. But, before this, you need to learn everything about GST and various things you need to keep in mind for the process of GST registration.

So, if you are a startup and still struggling to learn Singapore tax and regulations, this article might help you out. This article will let you understand all about GST, how you can register for it, and file it. Continue reading to find out.

What Is GST?

GST stands for Goods and Services Tax. It is a broad-based use tax levied on the import of goods along with all supplies of goods and services.

GST is also known as VAT (Value-Added Tax) in other countries.

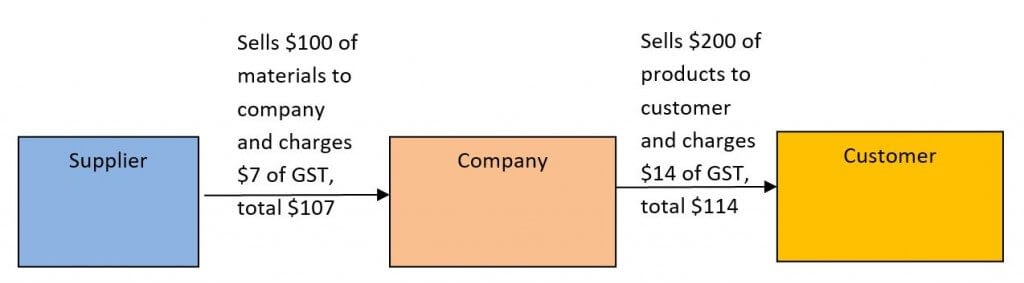

Simply put, GST is a consumption tax on the end consumer and businesses are the collecting agents that help to pay the government each time they provide a service or product to an individual or enterprise within Singapore. The below diagram will explain why your company is only collecting the GST on behalf of the government.

If we take a look at the example, the Company collects $14 of GST from its customer and pays $7 of GST to its Supplier. For this transaction, the Company will need to pay the excess $7 GST collected to the tax authority, IRAS.

Nearly all the goods and services are GST-taxable. The few supplies or transactions that are exempted from GST are sale or lease of residential properties, almost all financial services, and investment of platinum, gold, or silver in Singapore.

What is the current GST rate for Goods and Services supplied in Singapore?

The current GST rate in Singapore is 7%. Unlike other countries, there are no tiered or different GST rates for goods and services sold in Singapore.

Why you should do GST registration?

As a business owner or manager, you can decide whether your business needs to do GST registration even if your annual revenue is below SGD$1,000,000. The two types of GST registration are compulsory registration and voluntary registration.

Compulsory registration: You must register your company for GST if its taxable turnover for the past year is greater than SGD$1,000,000 or if it is expected to have a taxable turnover greater than SGD$1,000,000 for the upcoming year.

Voluntary registration: If your business has a taxable turnover of less than SGD$1,000,000, you can opt for voluntary GST registration. Businesses that choose to register their business with the GST voluntarily will be eligible for claiming input tax or GST incurred on business purchases and expenses.

Criteria for GST registration Singapore

You can complete the GST registration Singapore process via the following steps:

1. Complete And Submit An Application For GST Registration With IRAS

Firstly, you need to fill a paper or online form on http://mytax.iras.gov.sg. If you are filling an offline application, you need to send it to the following address:

55 Newton Road, Revenue House, Singapore 307987

2. Receive The Notification Of The Effective Date Of Registration From IRAS

Once your application has been approved, you will receive a confirmation letter from IRAS confirming that your organization is not registered for GST. Also, the letter you will receive will have the following information:

- The effective date of GST registration of the company

- The GST registration of the company

How To File GST Returns?

Every GST-registered business needs to file GST tax returns and account for GST to the IRAS. Keep the following things in mind while filing GST returns:

- You must file GST electronically on a quarterly basis.

- The payment of the GST or its tax return is due one month from the end of the GST accounting period.

- Even if your business has not undergone any GST transactions, you must still file a nil return.

- Also, you need to report both input and output tax.

Output tax: It is the GST that businesses collect from their customers.

Input tax: This is a tax that businesses pay on imported goods or purchases from suppliers.

If your input tax is less than the output tax, your company must pay the net GST to IRAS. On the contrary, if the input tax is greater, then IRAS will give you a refund.

Generally, IRAS will give you the GST refund within 1 month of filling the F5 return. However, to receive the GST refund, you must meet the following criteria:

- Your company must have filed all of its GST returns in a timely manner.

- Your company should not have any pending taxes or other payments to pay to IRAS.

- Your company should not be under an audit by IRAS.

If you submit the GST returns late, IRAS will impose a penalty of 5% for late payment. Also, you will also receive a demand note to make the pending payment. If your company still fails to pay within 60 days of receiving the demand note, you will have to face a penalty of 2% each month from IRAS. This 2% fine will be added for every completed month that your tax remains unpaid.

However, the total penalty cannot be more than 50%, which sums up to a total penalty of 55% for late payments of GST.

What Happens If My Revenue Exceeds One Million, And I Did Not Register?

If you register late or don’t register for GST, you may need to pay a fine of up to $10,000, along with a penalty of 10% of the tax due.

What Do I Need To Do After Becoming GST Registered?

After your GST registration singpore, you will be bounded by several responsibilities and obligations. You will have to file returns, pay for GST on time, and keep proper accounting and business records.

Can I Claim GST Paid Prior To GST Registration Singapore?

Yes, if certain conditions are met. The general rule is that if the GST has been paid on purchasing materials or supplies that will be used to produce supplies that are subsequently sold after GST registration or if the GST paid is for assets that are put into use for the subsequent production of GST taxable products and services, then it is possible to claim the GST paid prior to registration.

Conclusion

While setting up your business in Singapore, it is necessary that you understand every aspect of the business industry, including GST (Goods and Services Tax). Also, you should keep track of GST rates, types of supplies, etc. since these schemes and taxes are different for different businesses.

Do talk to us if you have any questions about GST in Singapore. You can drop us a note at the Contact us form or if you want to leave the hassle of filing your GST to us by engaging us, do let us know.