Singapore is one of the best countries to set up a business. This is evidenced by the number 2 ranking in the 2019 World Bank annual ratings for ease of doing business. Whether its incorporating a company or setting up a partnership, the process is straight-forward, fast and relatively painless compared to other jurisdiction.

Considering its tax incentives, cash grants, and financing schemes, the proactive government of Singapore is famous for promoting entrepreneurship. However, you may be wondering as a foreigner, what type of business entities are available for you as a foreigner.

In this article, you will read about the various types of business entities in Singapore and decide which one suits you and your business.

1. Private Company Limited By Shares

This is a business entity in Singapore that is registered under the Companies Act. The private company under this entity can have a maximum of 50 members, whereas a public company under this entity can even have more than 50 members.

This is the most popular choice of business entities for foreigners and for very good reasons. It offers limited liability for the shareholders and gives the flexibility of raising capital or qualifying for grants (you can refer to our business grants write up here), there are also numerous tax advantages for foreign residents individuals as dividends declared by a Singapore resident Company is exempted from tax. There are tax exemptions specifically for new Companies that are incorporated in Singapore but not for other business entities. In addition, there’s zero capital gain tax on subsequent sale of shares in Singapore. With all those advantages, you will wonder why should anyone even consider the other business entities!

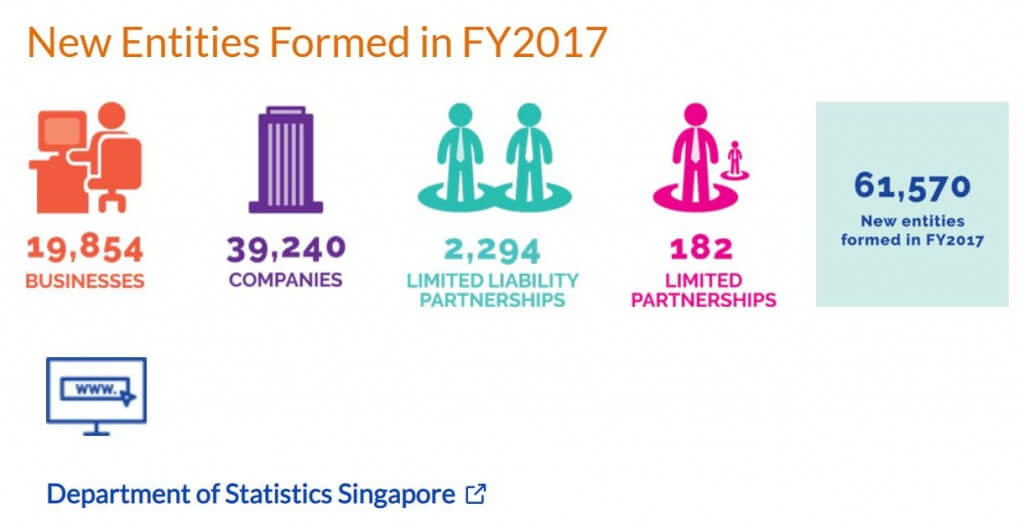

According to statistics collected in FY2017 on business entities created in Singapore. Starting a Company is the overwhelming winner, with over 63% of new entities opting for a private limited Company.

This type of business entity can also have 100% foreign shareholdings, however, it is a requirement that the Company should have at least one local director and you will need a registered filing agent to assist you in doing the registration. You can refer to our guide on Starting a business in Singapore for more information.

If you are looking to work in Singapore, it is also possible to apply for an employment pass under the Company.

2. Sole Proprietorship/ Sole Trader

Ideal for small businesses, a sole proprietorship is a type of business that is owned by a single person. This type of business does not support any separate legal identity from the person owning the company and holds the final decision in matters related to the business.

Since the business is entirely controlled and owned by the sole trader, he/ she has unlimited liability and can be sued in the business name or his/ her name. Also, this entity is not considered a separate legal entity.

If you want to be a sole proprietor in Singapore, you must be of 18 years of age, a resident of the country, and you should not be labeled as an undischarged bankrupt.

Simply put, if you are a foreigner residing outside of the country, you cannot apply for this partnership as the sole proprietor needs to be ordinarily a Singapore resident.

3. Ordinary Business Partnership Or General Partnership

If you are looking to start a small business with a local partner or a few local partners, an ordinary business partnership in Singapore might be a good idea for you. A general partnership is similar to a sole proprietorship in terms of liability, structure, and taxes.

This type of business firm is a partnership that supports at least two members and cannot exceed 20 members. If the partnership exceeds this number, the company is required to be incorporated under the Companies Act.

If you are an individual owner of the company, the tax rates applied will be personal, and for a company, corporate tax rates will be applied.

All the partners above 18 years can combine their skills, resources, and industry in this partnership with the sole goal of making profits. However, if none of the partners are residents of the country, the company must appoint an authorized representative who must be a Singapore resident.

The major demerit of this business entity is that it is not considered a separate legal entity. It means all the partners of the company would be personally held liable for the partnership’s losses and debts. That means there has to be a lot of trust between the partners as it does not matter who is responsible for these debts and losses.

4. Limited Partnership

A minimum of 2 members also forms a limited partnership, but there is no limit on the maximum number of partners. In this type of partnership, at least one partner must be a limited partner. Also, this type of entity has an option for limited liability.

It means the general partner will have unlimited liability, who will also be legally responsible for obligations and debts. Similar to the above entity, this partnership is also required to have an authorized representative of the country.

So, if none of the partners of your company are Singapore residents, you are required to appoint a manager who must be a resident of Singapore. Further, the partners under this entity are required to state their income share while filing their Personal Income Tax.

5. Limited Liability Partnership

Along with the option for limited liability, the owners also have the flexibility of operating as a partnership under this entity. In this type, you will get the benefits of both a partnership and private limited companies.

This business entity can be considered a separate legal entity from its partners. It can even own the company in the Limited Liability Partnership’s name.

For setting up a business under this entity, you can either be a local or a foreign resident and can be both individual and corporate bodies. If you are a foreign resident individual, you will need the assistance of a registered filing agent to submit the online application on your behalf.

Conclusion

So, we gave gone through the various options available in Singapore. Although each entity has its pros and cons, selecting a one that caters to your needs is solely dependent on your requirements and business type.

Before you start up the business, you can contact us here if you have any questions that you are unsure of or if you have decided to go ahead with incorporating a Company, you can take a look at our incorporation packages. here.