4 Common Marketing Challenges Small Business Face and How To Overcome Them

Starting a CompanyAs today’s market becomes more and more competitive, small business owners face numerous marketing challenges. Unlike existing industries, fresh ones are faced with budget restrictions and may not have a large group of people to help run things.…

The 7 Personality Traits All Successful Entrepreneurs Have in Common

Starting a CompanyThey say that being successful in business takes passion, attitude, a lot of work, and a dash of luck. Although there’s a lot of truth behind this, each business owner has a unique character that contributes to the success of their enterprise.…

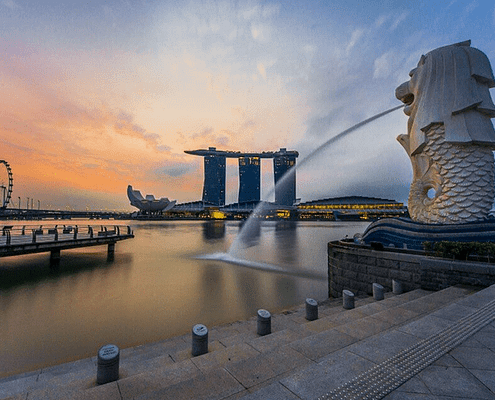

Why is Singapore a suitable place to start a business?

Starting a CompanySince the turn of the millennium, Singapore has been climbing up the ranks in global competitiveness. Where once we were ranked at a lowly 25th position back in 2003, we have now leapfrogged to 4th place in just 10 years. The World Economic…

3 Things Australian Entrepreneurs Should Know Before Setting Up Shop in Singapore

Starting a CompanyIntroduction

Singapore is an ideal location for Australian companies seeking to grow in and beyond because of its strategic location in Southeast Asia, business-friendly policies, and firm reputation as a regional business center in Asia.

In…

3 Important Tax Considerations before Starting A Singapore Company

Starting a CompanyDo you know what is the effective company tax rate in Singapore? If your answer is 17%, we will tell you why its much lower than that and why in this article.

Every year there are many new businesses getting set up in Singapore. It is primarily…

Starting a Business in Singapore? Keep These Things in Mind

Starting a CompanyDid you know Singapore is the second-best place after New Zealand to do business according to a report from World Bank? Yes, with a score of 86.2 out of 100, Singapore offers a fast and easy way to start a business. And, isn’t it what every…

Types of Business Entities for foreigners in Singapore

Starting a CompanySingapore is one of the best countries to set up a business. This is evidenced by the number 2 ranking in the 2019 World Bank annual ratings for ease of doing business. Whether its incorporating a company or setting up a partnership, the process…

What Is A Company Secretary For Singapore Companies?

Starting a CompanyAre you about to establish your business in Singapore? Are you fulfilling all the criteria required to set up a company in this country? You must have done all the relevant research and must be aware of all the rules and regulations. But, are…

Possible Tax Structures between Singapore and UK

Company taxation and GST, Starting a CompanyDisclaimer

This is purely regarded as academic information sharing. We hold absolutely no liability over any of the notes below, what you choose to do with this information, or any actions individuals or companies choose to make arising from…

How to lower Australia tax by incorporating a Singapore Company

Company taxation and GST, Starting a CompanyWe will show a couple of company structures an Australian can use that includes a Singapore company and that will save taxes.

Companies, jurisdictions, and tax – where is a company tax resident?

As a general rule, a company will be deemed…